Software starts at only $4,395 and it becomes even more cost-efficient the more users you add. For a custom quote, and to order, please contact a Fishbowl representative at 1-800-774-7085 Ext. Look below to see what your purchase. Pricing information for Fishbowl Inventory is supplied by the software provider or retrieved from publicly accessible pricing materials. Final cost negotiations to purchase Fishbowl Inventory must be conducted with the vendor.

What is Landed Cost?

Simply put, Part Landed Cost is the purchase cost of a part plus all the expenses of “landing” the part in your warehouse. In effect, the expense of shipping, duties, freight, import

Why Landed Cost?

With transactional database software, we know profit margins by item, because the costing of an individual item is tracked from receipt to shipment. This tracking capability enhances your view of sales. For example, you can see what your most profitable item and/or most profitable customer is. However, this knowledge is only as good as its accuracy (especially as it relates to the costing of the items sold) . For businesses that import goods, costs include not only what was paid for the item, but also what was paid to “land” the item in your warehouse. These ‘getting-it-into-the-warehouse’ costs can not only significantly add to the purchase cost, they can also vary greatly from part to part (depending on weight and volume) or from receipt to receipt (depending on method of shipment). The Landed Cost functionality of inventory software can distribute these freight costs to the received items, which then provides the true cost of the inventory sitting in your warehouse. Thus the landed cost functionality refines the usual practice of adding a freight percentage to the material cost of goods (based on historical gross numbers.)

Considerations of Landed Cost

The accounting people in the company need to be aware of a few things:

- The journal entry for Landed Cost “moves” the expense from the Cost of Goods (P&L sheet) to the Inventory Asset (balance sheet), thereby increasing the Asset Value of the company (company is worth more!) while decreasing expenses (the company is temporarily more profitable!).

- The shipping Cost of Goods is not recognized until the items are sold.

- Local freight is generally expensed upon receipt of the bill and not included in the Landed Cost (although this is a decision for Accounting to make and could be influenced by the proportional cost of the part and the freight).

Why Use Fishbowl For This?

I was asked why I thought a company needed Fishbowl Inventory to accomplish this. Why not just do it in QuickBooks?

Admittedly one can apply landed cost to parts in QuickBooks without Fishbowl Inventory. As in other accounting circumstances when QuickBooks lacks a certain functionality a “workaround” can be created. Indeed there are several workarounds for landed costing to be found out there in the QuickBooks community.

The operative word here is “workaround”, meaning to me there is additional work to get around the limitations of the program. Ssometimes a lot of it, often accomplished manually outside the system, and many times only to be done by the QB/accounting expert. Landed cost is a case in point.

Briefly the QuickBooks process would go like this:

- The parts are received at the purchased cost as usual; the average cost and total value are computed by QB.

- The landing costs (in our example customs and freight) on the vendor bills are posted to a shipping clearing account (in our example a shipping accrual account).

- Each received part’s proportion of these costs now has to be manually computed (often outside the system on spreadsheets).

- This additional cost per part is then manually added to the total value of the part in the Inventory Value Adjustment screen using the shipping clearing account as the adjustment account.

The three big downsides to the above workaround are that it can be a lot of extra work especially if many parts are received on an invoice; that anything done outside the system is prone to error with no inherent audit trail; and that the person doing the inventory value adjustment has to have those rights, rights that should not be given freely.

In consideration of the above my advice to a company who needs landed cost is to use Fishbowl Inventory.

Setting up Landed Cost in Fishbowl Inventory

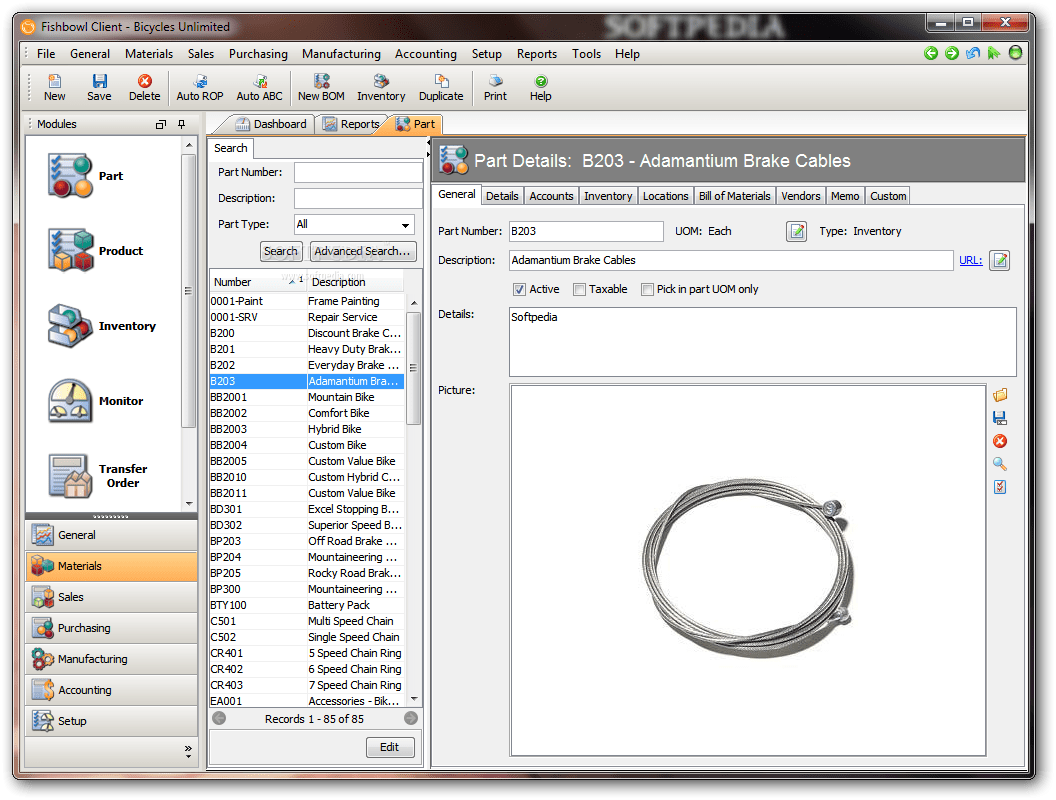

To set up for Landed Cost in Fishbowl Inventory, you first need to create shipping part numbers. Let us suppose we generally receive two bills for the cost of receiving parts; one from the freight forwarder, and one from the customs broker. You would then create two shipping type part numbers, one for each cost. In the Accounts tab, check that the expense account (freight COGS) and the accrual account (current liability) are mapped correctly.

After the receipt of a part we will use these part numbers to add their costs into the purchased cost of the part, coming up with a total landed cost.

Applying the landed cost

Receiving in Fishbowl is done in two processes: Receive and reconcile.

- Receive is concerned with quantity (how many came in).

- Reconcile deals with costs (is the bill correct and what additional costs do we have to add).

Landed cost is applied in the latter transaction. It is a good idea to have all the associated shipping costs reconciled into the part at the same time or soon after it is received into stock, since as stock it is available to be either consumed in a work order or shipped on a sales order, transactions that use the part’s costs. Unlike Quickbooks attempting to add costs after-the fact in Fishbowl Inventory will cause problems.

The Work Flow In Practice

In our example the company ordered 10,000 parts to be shipped 1,000 per month. The first 1,000 were received to which we need to apply the related shipping costs.To apply these costs click the reconcile icon.

A pop up screen appears; check the line to reconcile and click next.

Click the Add Items icon in the next screen to see the part entry and cost screen. Here we will add the two shipping items (customs and freight) with the billed costs. Since the customs and freight bills are from different vendors than the part we are receiving, uncheck the Add item to Vendor bill box. Click ok. Add the two shipping costs and click next.

The next step is to distribute the landed cost by part, calculating by the chosen parameter of the drop down menu. We will do it by cost per part. Each shipping cost will have its own screen with its own cost to spread. Click through the costs and spread as wanted.

The resultant summary screen shows us what we have accomplished. The landed cost is now $10.40 (1000 parts/$400 = $.40 per part added to purchased cost). The 2 bills are represented separately for their respective costs.

Fishbowl Inventory Software Cost

Clicking the finish button brings us back to the receiving screen with the part now reconciled (blue check mark) and showing the two bills, all of which will export to QuickBooks.

Fishbowl Landed Cost Accounting in QuickBooks

When correctly mapped the Fishbowl Inventory export to Quickbooks will give us the journal entries shown below:

The cost of goods for the both the customs and freight will be recognized when the part is sold (at the cost of $10.40). The shipping accrual amount will be debited out when the bills for the customs and freight are received and entered in accounts payable posting the expense to the accrual account (not to the cost of goods).

Fishbowl

Conclusion

Cost Of Fishbowl Inventory Software

For any company that imports goods from overseas, whether to use them in manufacturing a bill of materials (BOM) or distributing them directly, landed costing is essential in determining the real cost of parts in the warehouse. Without this real cost, true profit margins per part are near impossible to know. This alone is a good reason to add the Fishbowl Inventory “chunk” to your company’s suite of financial software.